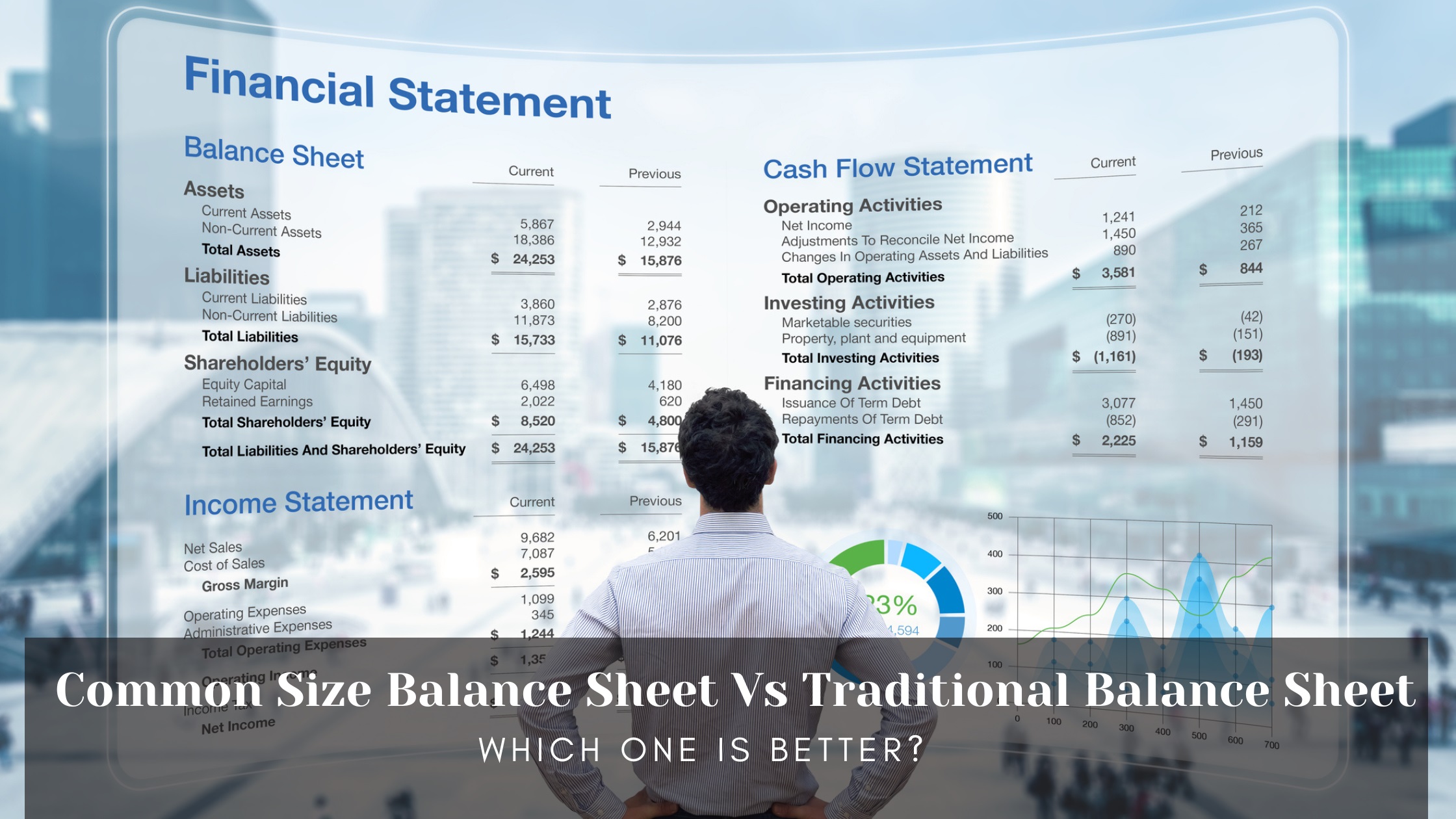

A Common Size Balance Sheet presents each item as a percentage of total assets, allowing for easy comparison across companies or periods, regardless of size. In contrast, a Traditional Balance Sheet lists actual dollar values for assets, liabilities, and equity, giving a snapshot of a company’s financial position at a specific point in time. While the Traditional Balance Sheet provides detailed financial data, the Common Size Balance Sheet helps in analyzing structural trends and efficiency by standardizing figures, making it a useful tool for benchmarking and financial analysis.

When analyzing a company’s financial health, balance sheets are indispensable. However, not all balance sheets are created equal. The Common Size Balance Sheet vs Traditional Balance Sheet comparison highlights how each format serves distinct purposes. A Traditional Balance Sheet provides a detailed snapshot of a company’s financial position using absolute dollar amounts, making it ideal for reviewing actual asset values, liabilities, and equity. In contrast, a Common Size Balance Sheet expresses each line item as a percentage of total assets, which allows for easier comparison across companies or time periods, regardless of size. Understanding the strengths, limitations, and ideal use cases of each helps investors, analysts, and business leaders determine which format is better suited for specific financial analysis scenarios. This blog explores both formats to provide clarity on when and why to use each one.